The BIGGEST interest rate shock in modern history. A thread on how bad things can get. 📉🤯💲 1/n

Let’s start with the broader economy. This is the largest move in the yield curve since the mid-1980s and certainly the biggest move in the era of financialized economies

The move suggests that ISM will print at index 30 in Q4 2023. A material recession is likely upcoming

2/n

The move suggests that ISM will print at index 30 in Q4 2023. A material recession is likely upcoming

2/n

What does it mean for equities?

The move in the 10yr real rate is the worst seen in decades. 10yr real rates suggest forward P/Es should trade around 11 implying a level of 2700 in S&P on UNCHANGED earnings assumptions

That is a drop of more than 30% from current levels

3/n

The move in the 10yr real rate is the worst seen in decades. 10yr real rates suggest forward P/Es should trade around 11 implying a level of 2700 in S&P on UNCHANGED earnings assumptions

That is a drop of more than 30% from current levels

3/n

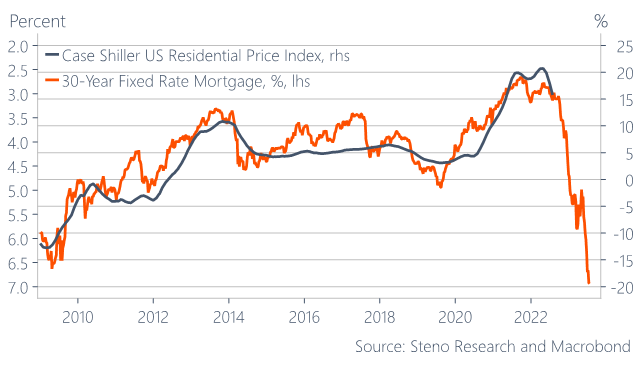

What does it mean for housing?

The move in the 30yr mortgage yield is simply unprecedented. The current average level around 7% implies a 20% drawdown in residential prices over the next 9-12 months on historical correlations

The correlation is VERY strong

4/n

The move in the 30yr mortgage yield is simply unprecedented. The current average level around 7% implies a 20% drawdown in residential prices over the next 9-12 months on historical correlations

The correlation is VERY strong

4/n

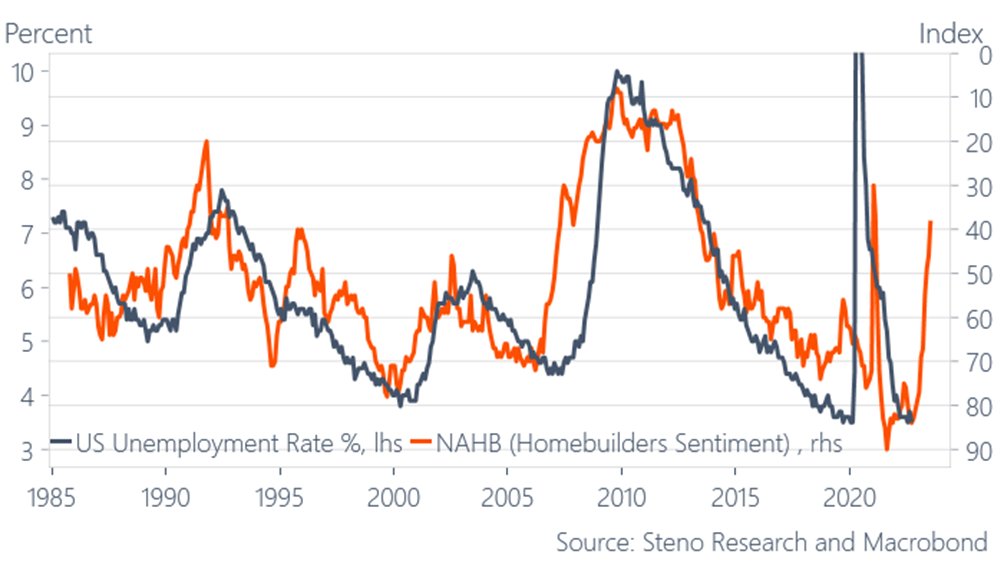

What does it mean for unemployment?

As housing goes, so goes the economy. The NAHB homebuilder’s sentiment is the best gauge of future unemployment (leads 9 months).

The historical relationship points to >7% unemployment in 9 months from now

5/n

As housing goes, so goes the economy. The NAHB homebuilder’s sentiment is the best gauge of future unemployment (leads 9 months).

The historical relationship points to >7% unemployment in 9 months from now

5/n

Unless central bankers admit to this outlook soon, it is safe to say that a pretty deep recession is unavoidable.

I don’t think they will admit to it (before it is too late), why a soft landing is very unlikely. More in my FREE newsletter here.

6/n

andreassteno.substack.com/p/steno-signal…

I don’t think they will admit to it (before it is too late), why a soft landing is very unlikely. More in my FREE newsletter here.

6/n

andreassteno.substack.com/p/steno-signal…

Would you like me to create a similar thread for other regions?

Please leave suggestions below. Thanks for reading.

7/n

Please leave suggestions below. Thanks for reading.

7/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh